Why Traditional Banks Are No Longer the Only Funding Option

American Financial Services LLC

For decades, small business owners looking for funding had one main option: their local bank. But times have changed. In today’s fast-moving business world, traditional banks are no longer the only source of capital—and for many entrepreneurs, they’re not even the best one.

Let’s explore why alternative funding options are growing in popularity, what they offer that banks don’t, and how you can take advantage of them.

1. Traditional Bank Lending Has Become Harder to Get

After the 2008 financial crisis, banks tightened their lending requirements. This meant stricter credit score minimums, more documentation, and longer approval times.

For many small business owners—especially startups or those with less-than-perfect credit—meeting these requirements is nearly impossible. Even well-established businesses can face months of waiting only to receive a denial.

2. Alternative Lenders Offer Faster Approvals

One of the biggest frustrations with banks is the slow process. Gathering years of tax returns, bank statements, business plans, and collateral documents can take weeks. Then comes the review process, which can drag on for months.

Alternative lenders have streamlined the process. Many can approve applications within 24–72 hours and fund in as little as a week. This speed is a game-changer for businesses that need to act quickly on opportunities.

3. More Flexible Requirements

While banks often require high credit scores, significant collateral, and lengthy operating histories, alternative funding sources look at the bigger picture.

Many consider factors like:

Your current business revenue

Your industry’s growth potential

Your cash flow patterns

Your existing contracts or accounts receivable

This means even newer businesses or those recovering from financial setbacks can still qualify.

4. Wider Variety of Funding Options

Traditional banks mainly focus on term loans and lines of credit. But today’s entrepreneurs can choose from a variety of solutions, including:

Short-term working capital loans

Equipment financing

Invoice factoring

Merchant cash advances

Credit card stacking

These options can be tailored to your business’s specific needs and repayment ability.

5. Technology Has Leveled the Playing Field

Fintech (financial technology) companies have revolutionized business lending. By using data analytics, AI-driven underwriting, and secure online platforms, they can process applications faster and match businesses with the right funding options instantly.

For small businesses, this means less paperwork, faster decisions, and more competitive rates.

The Bottom Line

Banks still play an important role in business finance, but they’re no longer the only—or always the best—option. Alternative lenders offer speed, flexibility, and tailored solutions that traditional banks simply can’t match.

If your business needs funding, don’t limit yourself to the old way of doing things. Explore the growing range of alternative financing solutions that can help you seize opportunities and grow on your terms.

Ready to Get Started?

If you’re ready to take your startup business to the next level, we’re ready to help. Contact American Financial Services today to learn more about our funding options and see how easy it is to get the capital you need — when you need it.

Apply now and let’s grow your business together!

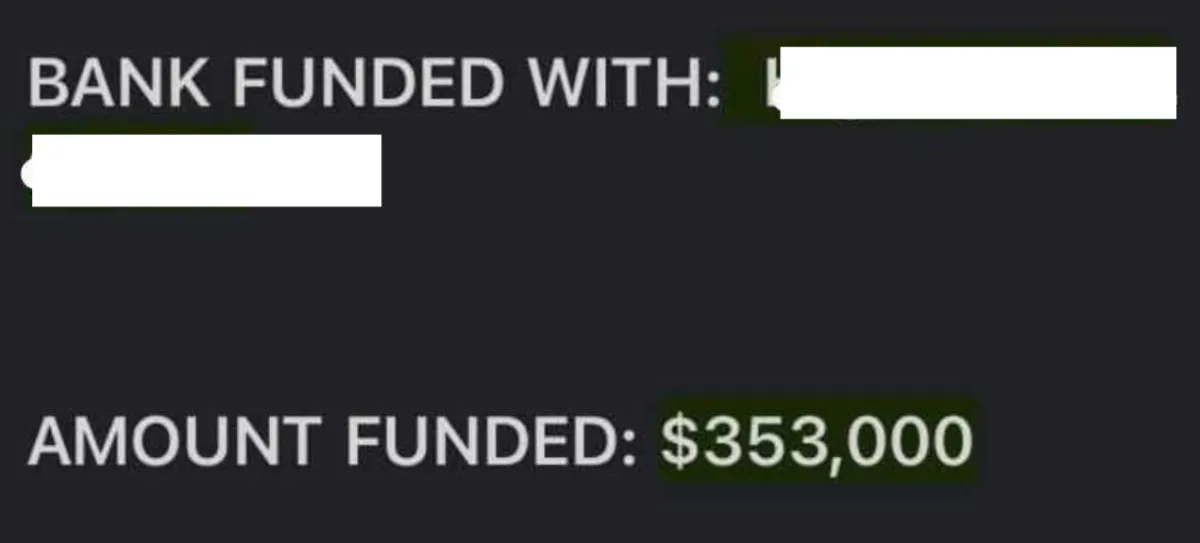

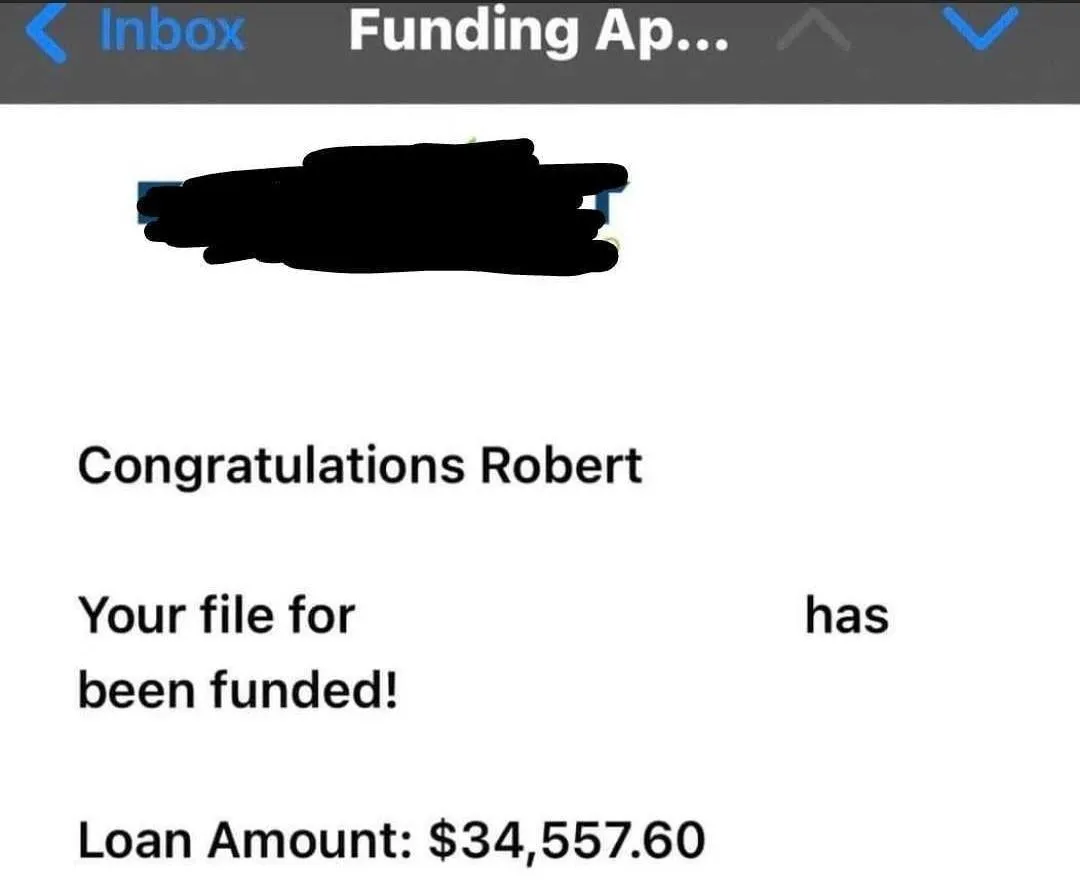

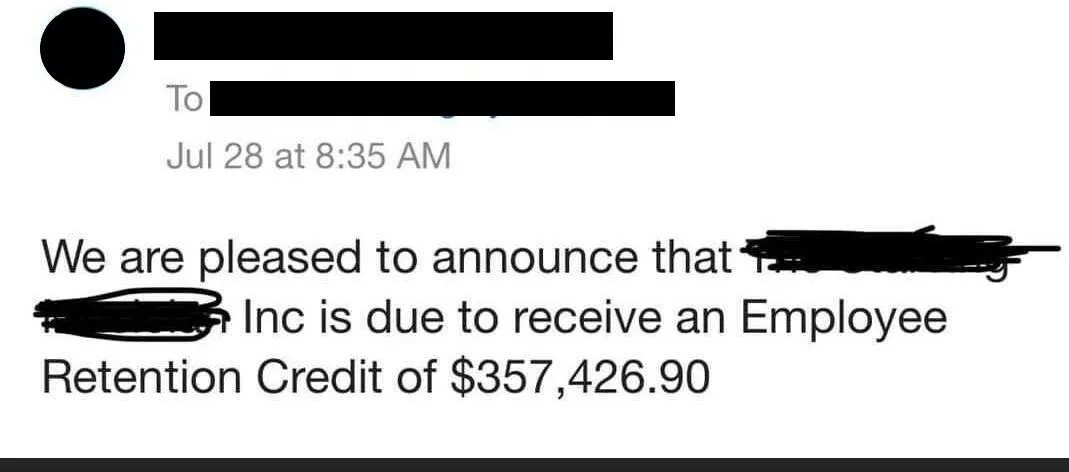

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.