SBA Loan

Lowest rates available with an SBA 7a, 504, or express loan.

An SBA loan can be a game-changer for small businesses looking for financial assistance. The Small Business Administration (SBA) provides loan programs specifically designed to support and promote the growth of small businesses. SBA loans offer several benefits, such as lower down payments, longer repayment terms, and more flexible eligibility requirements compared to traditional bank loans.

This accessibility makes it easier for businesses to secure the funding they need for various purposes, such as working capital, equipment purchases, real estate investments, or refinancing existing debt. Moreover, SBA loans often come with competitive interest rates, which can significantly reduce the cost of borrowing and improve the overall financial health of the business. Beyond the financial aspect, SBA loans also provide valuable guidance and resources through the SBA network, offering expertise and support to help businesses succeed. By offering affordable financing and expert assistance, SBA loans play a vital role in fostering entrepreneurship and fueling the growth of small businesses.

0% INTEREST CREDIT CARDS

High-limit cards with 0% interest for 12–24 months. Build your business the smart way.

BUSINESS LINE OF CREDIT

Access capital for your business when you need it and only pay interest on the funds you use.

EQUIPMENT FINANCING

Get funding to purchase equipment for you business to keep on growing.

WORKING CAPITAL

Quick and simple cash available for any business purpose.

BUSINESS & PERSONAL TERM LOANS

Up to $250K in fast, flexible funding—for growth, debt relief, or anything in between.

Real Estate Investor Funding

Get funding for your next real estate project. Fix and Flip Funding, Single Family/Multi Family and more.

INVOICE FACTORING

Get paid upfront for your 30-60 or 90 day old invoices

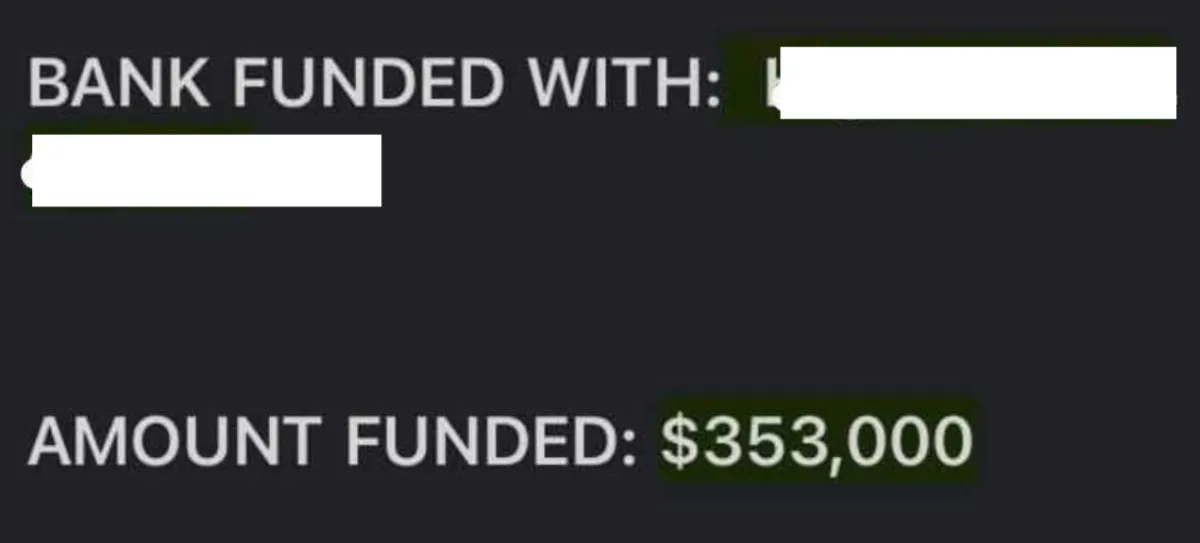

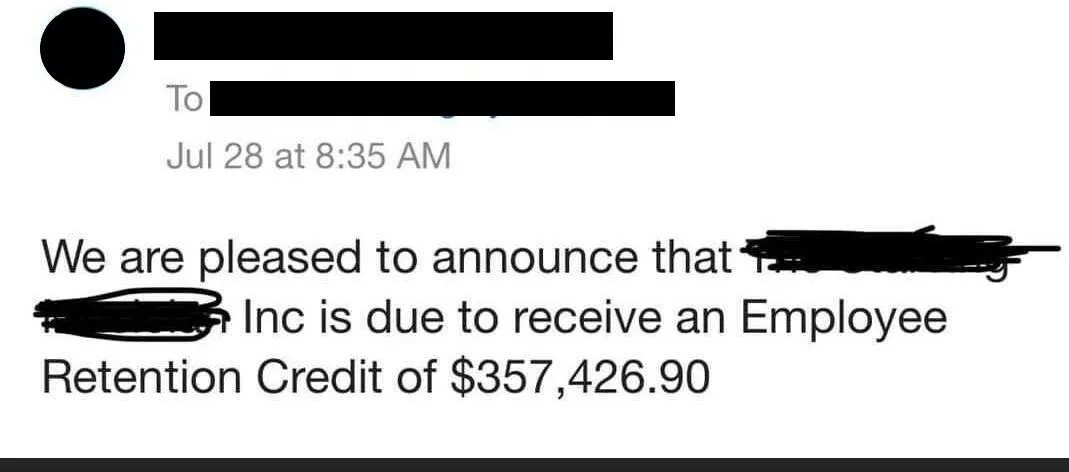

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.