Why More Entrepreneurs Are Choosing Alternative Lenders Over Banks

American Financial Services LLC

In the past, business owners who needed funding had only one real option walk into a bank,

fill out mountains of paperwork, and hope they got approved.

But times have changed. Over the past decade, alternative lending has become a go‑to funding source for entrepreneurs looking for faster, more flexible options.

So why are so many business owners moving away from traditional banks and choosing alternative lenders instead?

Let’s break it down.

1. Faster Approvals and Funding

One of the biggest frustrations with banks is how long it takes to get a loan approved.

It’s not unusual for the process to take weeks — sometimes months.

Alternative lenders, on the other hand, often approve and fund deals within 24 to 72 hours.

When you need money to jump on a new opportunity, cover payroll, or purchase inventory, speed matters.

2. Less Paperwork, Fewer Hoops

Banks are known for strict lending requirements:

Years of financial history

High credit scores

Collateral requirements

Endless documentation

Alternative lenders focus more on your current business performance rather than just your past credit history. Many will approve loans with:

Lower credit scores

Limited operating history

No collateral

That means more businesses get a “yes” instead of a “sorry, you don’t qualify.”

3. Flexible Loan Products

Banks typically stick to a small set of loan types, like term loans or lines of credit.

Alternative lenders offer a wider range of products designed to fit different needs:

Merchant cash advances

Equipment financing

Invoice factoring

Short‑term working capital loans

Credit card stacking programs

This flexibility allows entrepreneurs to match the right funding to the right situation.

4. Approval Based on Business Potential

Banks often focus on your past — your credit history, tax returns, and balance sheets.

Alternative lenders look at where your business is going, not just where it’s been.

If your sales are growing or you’ve landed a big contract, that future potential can help you secure funding even if your past numbers aren’t perfect.

5. Personalized Service

Many alternative lenders work closely with business owners to find creative funding solutions.

Instead of being treated like just another account number, entrepreneurs often work directly with a dedicated funding specialist who understands their industry and goals.

The Bottom Line

Banks will always have a place in the lending world, but for many entrepreneurs, they’re simply not the fastest or most flexible option.

Alternative lenders are filling the gap by offering:

Speed

Flexibility

Accessibility

Ready to Get Started?

If you’re ready to take your startup business to the next level, we’re ready to help. Contact American Financial Services today to learn more about our funding options and see how easy it is to get the capital you need — when you need it.

Apply now and let’s grow your business together!

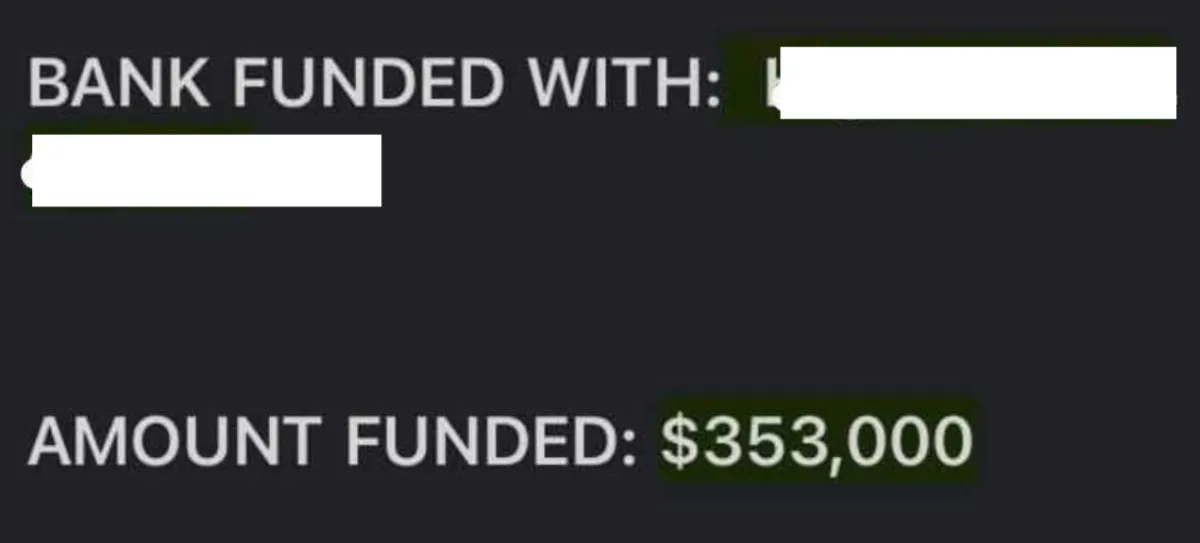

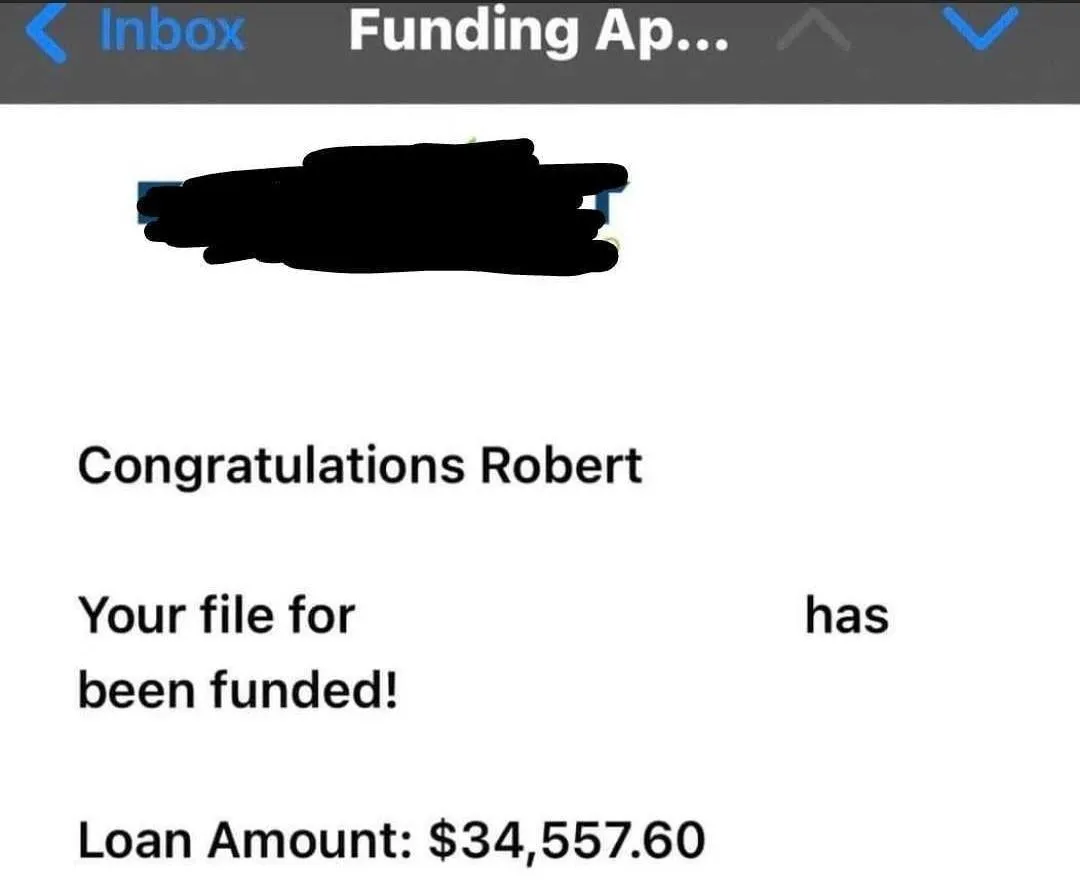

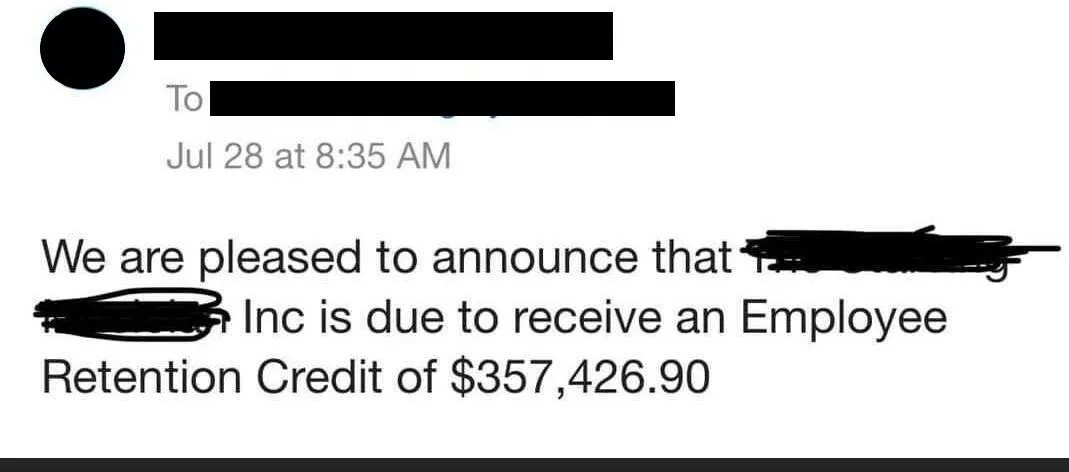

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.