What Lenders Look for Before Approving Your Business Loan

American Financial Services LLC

Securing a business loan can be a game‑changer for growth, but getting approved isn’t always easy. Every lender whether it’s a bank or an alternative financing company has its own process and priorities. Still, there are a few key factors that almost every lender looks at before deciding to say “yes” or “no” to your application.

Understanding these factors ahead of time can help you prepare, improve your chances of approval, and even

secure better terms.

1. Your Credit History

Your credit score is often the first thing lenders check. It’s a quick way for them to measure how you’ve handled debt in the past. A strong credit score shows that you’ve been responsible with borrowing and repayment, while a lower score may signal risk. Both personal and business credit scores can be reviewed, depending on the type of loan you’re applying for.

If your credit score isn’t where you want it to be, it’s worth taking time to improve it before applying. Paying down existing debt, making on‑time payments, and disputing errors on your credit report can all make a difference.

2. Business Financials

Lenders want to see that your business is generating enough revenue to handle loan payments. They’ll look at your income statements, bank statements, and tax returns to get a clear picture of your financial health. Strong, consistent cash flow reassures them that you’ll be able to repay the loan without trouble.

Even if your revenue isn’t huge, showing steady growth can work in your favor. Be prepared to explain any fluctuations or dips in income.

3. Time in Business

The longer you’ve been in business, the more confident a lender will feel about your stability. Many traditional banks prefer to work with companies that have been operating for at least two years. Alternative lenders are often more flexible and may approve funding for businesses that have only been running for six months to a year — but they’ll still want to see some track record.

4. Debt‑to‑Income Ratio

Lenders calculate your debt‑to‑income ratio to see how much of your revenue is already committed to paying other debts. A lower ratio means you have more breathing room in your finances and are less likely to struggle with additional payments. If you already have several large loans, that can be a red flag.

5. Collateral or Assets

Some loans require collateral, which is something of value (like equipment, property, or inventory) that the lender can claim if you don’t repay. Even if you’re applying for an unsecured loan, having assets on your balance sheet can strengthen your application.

6. Purpose of the Loan

Lenders want to know exactly how you’ll use the funds. Whether it’s for equipment, inventory, expansion, or working capital, having a clear, specific plan shows that you’ve thought things through and are likely to use the money wisely.

7. Industry and Market Conditions

Some industries are considered higher risk than others. Lenders may factor in the economic outlook for your field when making their decision. If you’re in a seasonal business or a volatile industry, you may need to demonstrate how you manage those challenges.

Final Thoughts?

The more you understand what lenders look for, the better you can prepare. Strong credit, healthy financials, a clear plan for the loan, and a demonstrated ability to repay can make all the difference. Even if you don’t meet every traditional requirement, alternative lenders can offer more flexible solutions that fit your situation.

Ready to Get Started?

If you’re ready to take your startup business to the next level, we’re ready to help. Contact American Financial Services today to learn more about our funding options and see how easy it is to get the capital you need — when you need it.

Apply now and let’s grow your business together!

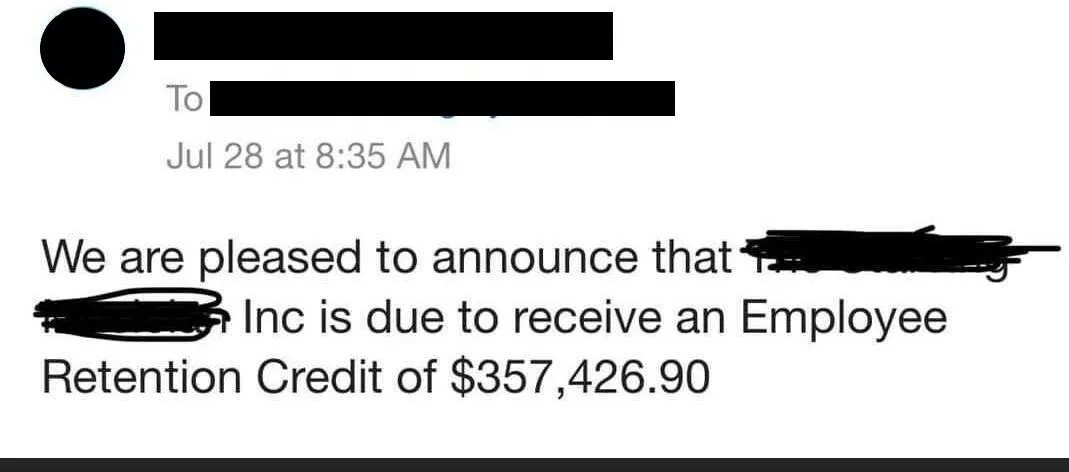

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.