Cash Flow Crunch? Here’s How a Line of Credit Can Keep Your Business Moving

American Financial Services LLC

Running a business is exciting — but it’s not always smooth sailing. One month, revenue is strong; the next, an unexpected expense or a slow-paying customer can leave you scrambling to cover bills, payroll, or supplier costs. This “cash flow crunch” is one of the most common challenges small and growing businesses face.

The good news? A business line of credit (LOC) can be the safety net that keeps your operations steady, your staff paid, and your growth plans on track.

What Is a Business Line of Credit?

Think of a line of credit as a flexible pool of funds your business can draw from whenever you need it. Unlike a traditional loan where you receive one lump sum, an LOC works more like a credit card:

You’re approved for a certain limit.

You borrow only what you need.

You pay interest only on the amount you use.

As you repay, those funds become available again.

This makes it one of the most versatile financing tools available to business owners.

Why Businesses Struggle With Cash Flow

Even profitable companies can run into short-term financial gaps. Common causes include:

Delayed customer payments — clients taking 30–90 days to pay invoices.

Seasonal sales cycles — slow periods where expenses outweigh income.

Unexpected expenses — equipment repairs, supply shortages, or emergencies.

Growth opportunities — needing to buy inventory or hire staff before revenue catches up.

Without a backup plan, these issues can put unnecessary stress on your business.

How a Line of Credit Can Help

Here are some of the most impactful ways a LOC can solve cash flow challenges:

LOC vs. Traditional Loan: What’s the Difference?

A LOC could be a smart move if your business:

Has fluctuating income or seasonal cycles.

Deals with delayed invoice payments.

Wants a safety net for emergencies.

Needs flexibility to act on growth opportunities.

The key is securing the right limit and terms based on your credit, revenue, and business goals.

Ready to Get Started?

If you’re ready to take your startup business to the next level, we’re ready to help. Contact American Financial Services today to learn more about our funding options and see how easy it is to get the capital you need — when you need it.

Apply now and let’s grow your business together!

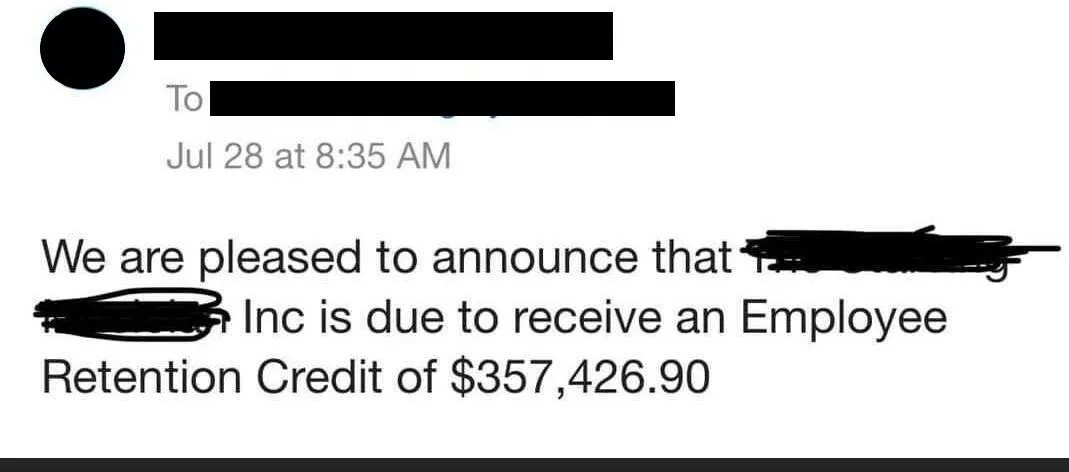

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.