5 Smart Ways to Use Business Funding to Grow Faster

American Financial Services LLC

Discover 5 strategic ways to use business funding to grow your company faster. Learn how to maximize capital for expansion, equipment, marketing, and more.

Running a business takes vision, hard work, and—most importantly—capital. Whether you’re a startup or an established company, having access to the right funding can make all the difference between simply staying afloat and accelerating your growth. The good news? Business funding isn’t just for emergencies—it can be a powerful tool to take your business to the next level.

Here are five smart ways to use business funding to grow faster:

1. Expand Your Operations

If your business is thriving but limited by space, staffing, or production capacity, funding can help you scale. Expanding to a new location, hiring additional employees, or upgrading your infrastructure allows you to meet growing demand without slowing down.

2. Invest in Marketing and Advertising

Even the best products and services need visibility. A dedicated marketing budget fueled by business funding can bring in more customers, strengthen your brand, and boost sales.

This can include:

Digital ads (Google, Facebook, Instagram, LinkedIn)

SEO and content marketing

Influencer or referral partnerships

3. Upgrade or Purchase Equipment

Outdated or broken equipment can limit efficiency and quality. With equipment financing or a business loan, you can purchase or lease the tools and technology you need to streamline operations.

4. Manage Cash Flow and Pay Off High-Interest Debt

Cash flow gaps are one of the biggest challenges small businesses face. Using funding strategically can cover short-term expenses, payroll, or inventory purchases.

Additionally, refinancing high-interest debt with a lower-cost loan can save you money each month—freeing up cash for reinvestment.

5. Launch New Products or Services

Innovation is key to staying competitive. Funding can give you the capital needed to research, develop, and launch a new product line or service offering—without draining your reserves.

Final Thoughts

The smartest business owners don’t wait until they’re desperate for cash to secure funding. Instead, they use it proactively to create growth opportunities. By strategically applying capital toward expansion, marketing, equipment, debt management, and innovation, you position your business for long-term success.

Ready to Get Started?

If you’re ready to take your startup business to the next level, we’re ready to help. Contact American Financial Services today to learn more about our funding options and see how easy it is to get the capital you need — when you need it.

Apply now and let’s grow your business together!

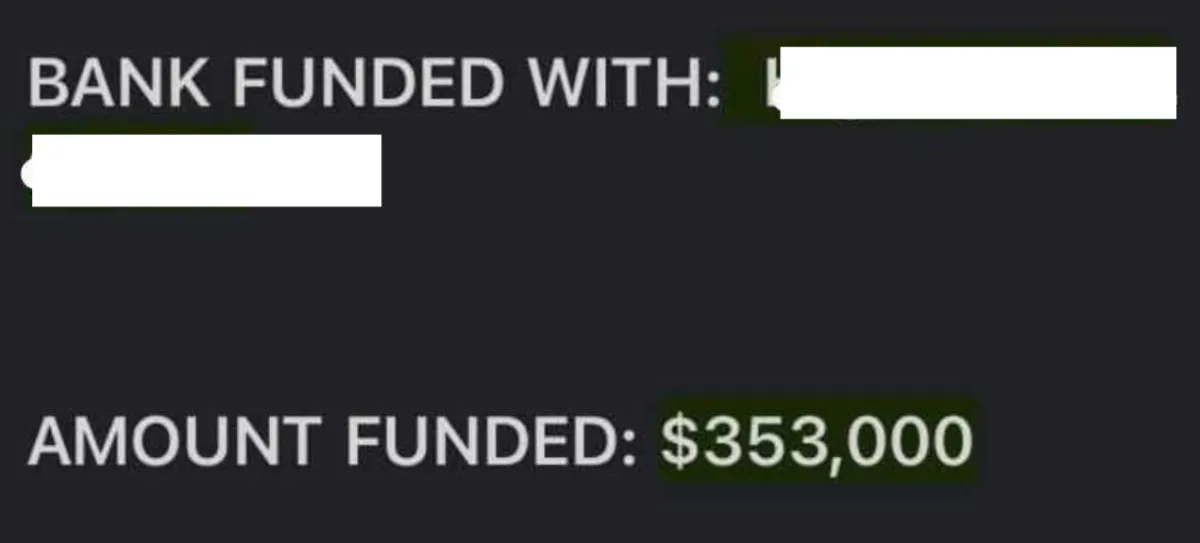

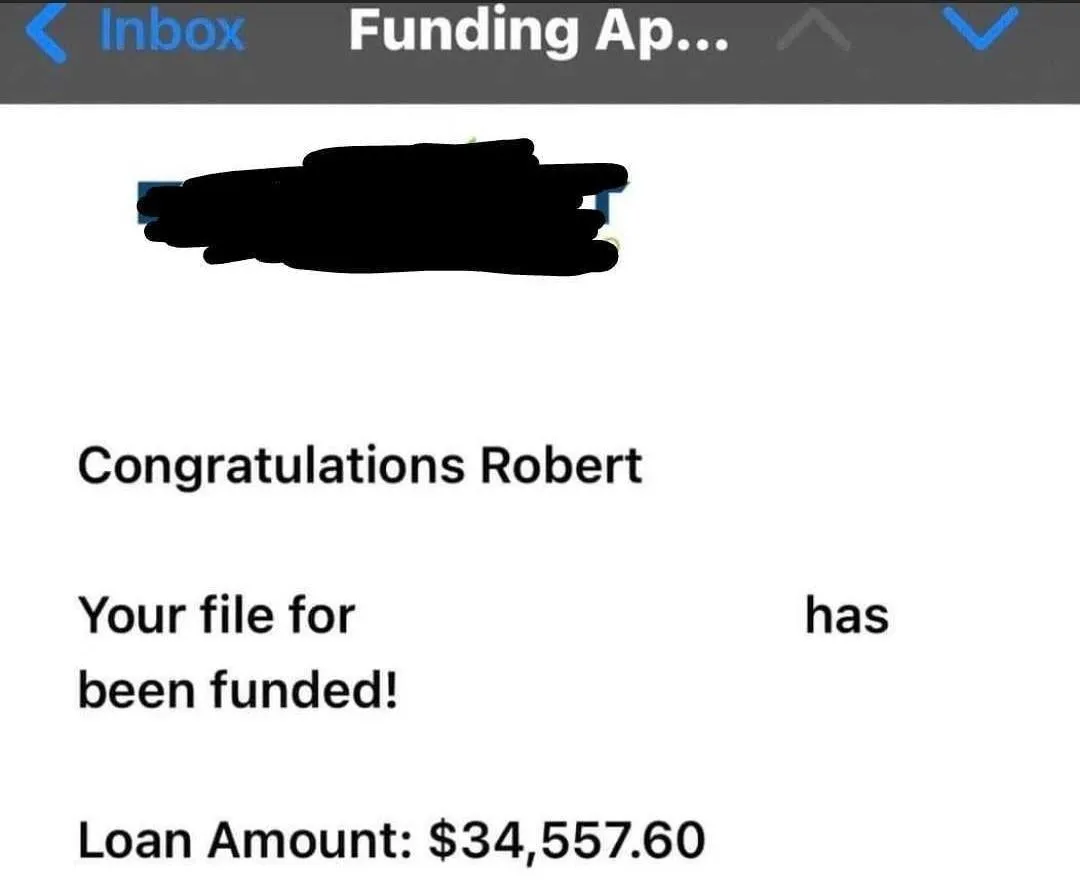

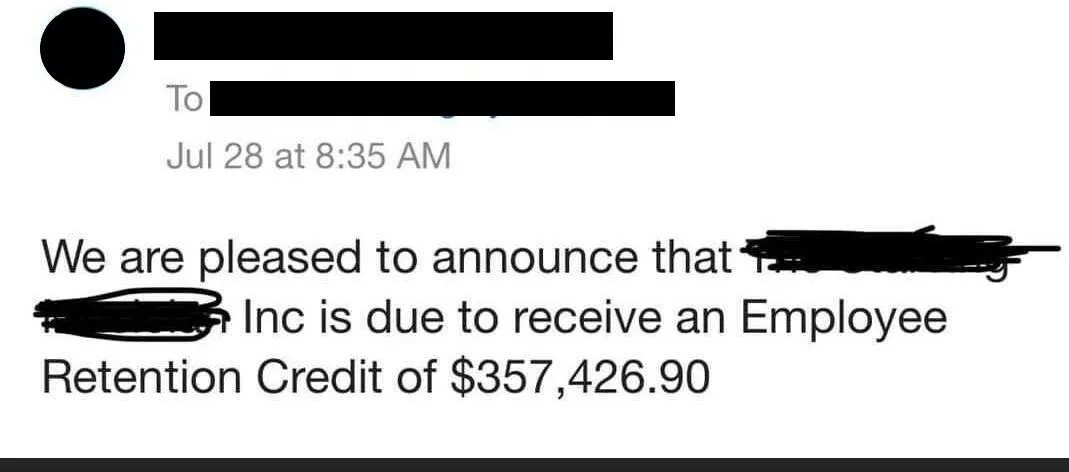

Hear From Our Clients

AMERICAN FINANCIAL SERVICES LLC

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.

© 2026 | ALL RIGHTS RESERVED | LOANS SUBJECT TO LENDER APPROVAL

The operator of this website is NOT a lender, does not make offers for loans, and does not broker online loans to lenders or lending partners. Customers who arrive at are paired with a lender or a lending partner, and redirected only to lenders or lending partners who offer business loan products.